Proposition 15, to finally tax commercial real estate in California the way every other state in the nation does, is a once in a lifetime opportunity to raise a whopping $10 billion-plus dollars a year in revenue without costing 99.99% of taxpayers a dime.

Since 1978, multi-billion dollar real estate companies have freeloaded off the unintended consequences of Prop. 13, which froze real estate assessments so that homeowners, especially seniors, would not be forced to move because rising valuations could cause their taxes to skyrocket.

The giveaway-to-billionaire payout of Prop 13 has cost California about $10 billion per year in current dollar terms–in aggregate, more than the entire California state debt of $150 billion.

The consequences of taking a tax break meant to protect homeowners and applying it to ultra-wealthy commercial and industrial real estate owners were unintended for voters, but they were quite intentional for the real estate industry, and its lobbyists, who pumped countless millions onto promoting a story that the measure was needed to make sure grandma wasn’t forced out of her home.

What was expertly hidden from the public was how the same law that applied to homeowners also applied to many of the largest corporations as well as the wealthiest 1% of 1% of Californians, those who own commercial real estate like downtown Los Angeles, San Francisco and Disneyland, as well as shopping centers, industrial parks and retail space.

Nor did Jane Q. Public ever imagine that this law would be stretched and stretched into outrageous loopholes that allowed freeloaders like Disneyland, along with owners of skyscrapers and office parks, to sell properties for hundreds of millions of dollars while retaining, for state taxation purposes , their original valuations from 1978.

As a LA Times columnist reported, “New, market-value property assessments of commercial properties kick in under current law only when majority ownership changes. That has enabled publicly traded corporations to avoid new assessments even though their stock ownership may have rolled over many times, and it allows landowners to buy and sell and yet maintain lower assessments by dividing purchases among enough entities so that none holds majority ownership. Companies such as Chevron, Intel and IBM own land whose assessments are still based on 1975 values, while nearby properties are assessed at values as much as 50 times higher, according to the initiative’s organizers.”

So when these mega-corporations sell a property, it is not exactly sold, for tax purposes, the way an ordinary person’s home would be sold and reassessed at market value.

Because in the United State, corporations are people when it comes to the countless millions of dollars in free speech they spend to market their messages in Sacramento and Washington. But when it comes to paying a fair share of their taxes, they are very special people indeed.

Thanks to this loophole, the eight California real estate moguls who made the Forbes 400 list of the wealthiest Americans (each with a minimum net worth of $2.5 billion) also receive hundreds of millions of dollars in tax breaks annually from the taxpayers of California. This includes the wealthiest real estate magnate in the United States, Donald Bren, who is personally worth more than $15 billion.

Proposition 15 closes this loophole only for commercial and industrial property, and only to holdings worth more than $3 million, which means that small property owners and farms would be spared the need to pay extra real estate taxes.

It is estimated that Proposition 15 will single-handedly generate $8 billion to $12 billion every year, which would be split 60% to local pandemic-strapped communities, and 40% to struggling schools across the state.

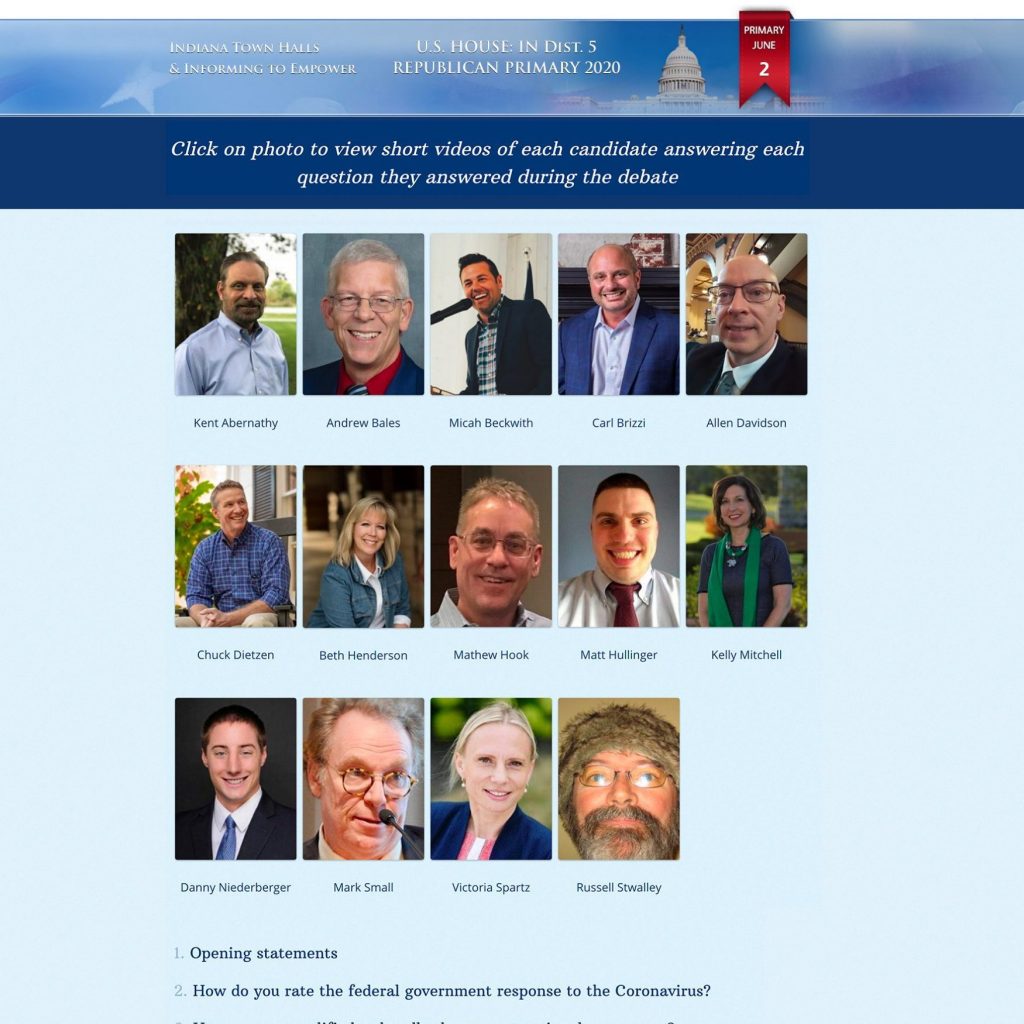

Not surprisingly, every prominent Democrat, labor union, teachers, parent and public interest group in the state enthusiastically support it (you can see the list here).

Surprisingly however, Sonoma County’s Press Democrat, in this recent editorial, has joined the state’s anti-tax groups and prominent Republicans in opposing it. The editorial argued, “Supporters of Proposition 15 say the $3 million floor exempts all but the richest property owners. However, like homeowners four decades ago, there’s no guarantee that they have cash on hand to pay tax bills based on unrealized gains. . . And nothing in Proposition 15 stops commercial landlords from passing the cost to tenants, including small business owners. Indeed, many business leases include charges for property taxes.”

Voters will be hearing millions of dollars worth of ads repeating this dubious “what about the little guy” argument during the next few weeks. It was the same line the powerful real estate industry used to pass this loophole-laden tax bill in the first place.

What’s fraudulent about this argument is that it deliberately ignores the fact that we live in a free market economy, and that if rents are raised because real estate taxes go up, tenants are free to move to other locations. There was already a severe Amazon-driven depression over retail space going on across the state to begin with, now greatly exacerbated by a pandemic economy that is tragically forcing thousands of retailers and restaurants to close their businesses.

No, this tax is not going to be paid by mom and pop businesses. Instead, it will be paid for by the wealthiest among us.

People like, not coincidentally, the lead investor and “managing member” of the Press Democrat’s parent company, Darius Anderson. Anderson is CEO of the multi-billion dollar real estate developer Kenwood Investments.

His company’s real estate bills will soon increase if we pass Proposition 15.

California voters are unlikely to shed any tears about that.